Today's Top Stories From the Breitbart News Desk

The Department of Labor will issue its report on September payrolls, unemployment, and wages on Friday. It may be the most hotly anticipated jobs report in recent memory.

Wall Street is expecting that 250,000 workers were added to nonfarm payrolls in the month, down from 315,000 in August. Private payrolls are expected to rise by 280,000 workers, while public sector employment is expected to show a seasonally adjusted decline. The unemployment rate, which ticked up to 3.7 percent in August from 3.5 percent in July and 3.6 percent in the four months prior, is forecast as unchanged.

Average hourly earnings, a key measure in our age of rampant inflation, are expected to rise 0.3 percent compared with July, the same pace of gains in the prior month. That's expected to be good for a 5.1 percent year-0ver-year gain, one-tenth below the annual gain recorded in August. The average workweek is seen as coming in unchanged as well.

Recent history, however, suggests that the risk is for an upside surprise. Economists have been consistently underestimating payroll growth this year. Seven of the last eight months have seen the jobs figure exceed the consensus forecast. August was the fifth straight month of the forecasts undershooting the reported number.

The private payroll figure reported by ADP surprised to the upside this week thanks to heavy hiring in the services side of the economy. ADP economist Nela Richardson said the firm was seeing evidence that "people are returning to the labor market." That could mean welcome growth in labor force participation, but it also could indicate that payroll growth will be bigger than expected.

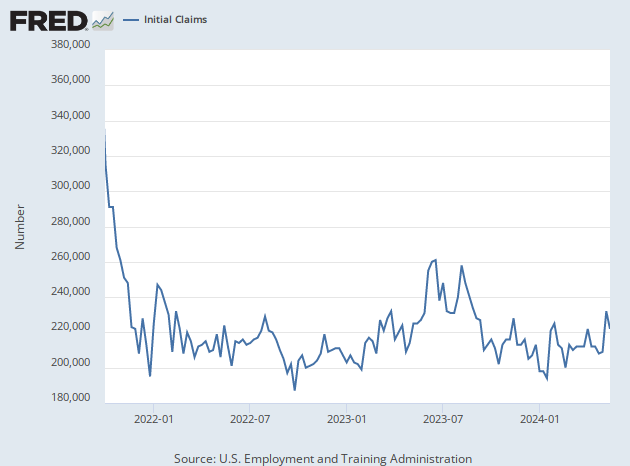

Jobless claims marched downward in September, suggesting that employers still have a voracious appetite for workers. In the mid-month survey week, initial jobless claims were at 209,000, a drop of 52,000 from the recent July peak. They fell all the way to 190,000 by the end of the month. This suggests that payroll growth likely remained strong in September.

There was, of course, a big drop in job openings in August, according to the most recent Job Openings and Labor Turnover Survey (JOLTS). Yet even after falling by 1.1 million, there were still 10.1 million openings. What's more, hiring kept up its pace, the survey showed, with 6.3 million people taking a new job even while hiring by the federal government declined. The number of quits was basically unchanged at the extraordinarily high level of 4.2 million. This paints a picture of a labor market that went into September only slightly less hot than it was in August and July.

Of the five regional Federal Reserve banks that conduct manufacturing sector surveys, the Dallas Fed and the New York Fed showed hiring accelerating in September. The Dallas Fed described employment growth as "robust" and unchanged from August. Hiring expanded at a slower pace in the Richmond Fed and Philadelphia Fed districts. The Kansas City Fed indicated the pace of hiring was unchanged from the prior month.

The Conference Board's consumer confidence survey showed that 49.4 percent of households see jobs as "plentiful," up from 47.6 percent a month earlier. Just 11.4 percent said jobs are hard to get, down slightly from 11.6 percent. That hints at a labor market acceleration rather than the slowdown seen in JOLTS and the consensus forecast.

If the jobs or wages figures come in significantly higher than expected, the market will likely interpret this as a sign that this year's Fed hikes have not sufficiently relieved inflationary pressures. This would set the stage for an upward revision in the expected path of future Fed hikes, which is likely to trigger a downward revision in asset prices. In other words, a "better than expected" figure on Friday will likely trigger a sell-off in stocks.

It's possible, of course, that the number could fall short of expectations. If so, this will likely be taken as a sign that the Fed's efforts are working already to cool off the labor market. That would be a positive for stocks as it suggests a potentially lower terminal rate and an earlier end to hikes next year.

President Joe Biden speaks about gas prices at the White House on June 22, 2022. (Drew Angerer/Getty Images)

President Joe Biden speaks about gas prices at the White House on June 22, 2022. (Drew Angerer/Getty Images)

Biden's OPEC Humiliation

Oil prices continued to climb on Thursday following the OPEC+ decision to cut oil production by two million barrels a day. The Wall Street Journal editorial page correctly describes this as a "diplomatic humiliation" for the Biden White House.

The Biden administration is understandably outraged at being humiliated, particularly after the president repudiated his pledge to treat the Saudis as pariahs by flying to the kingdom for the fist bump summit. But the OPEC+ members have a very fair case to make that they are responding rationally to the policy of the Federal Reserve. The Fed is attempting to slow down the U.S. economy to combat inflation. This will almost certainly lower demand for oil relative to where it would have been. So why should OPEC+ continue to supply as much in the face of falling demand?

As we pointed out yesterday, it's extremely hypocritical for the Biden administration to complain about other countries not producing enough petroleum. A new study by Stephen Moore and Casey Mulligan highlights that. It indicates that the U.S. would be producing between 2 and 3 million more barrels of oil a day if Biden had only continued the Trump administration's policies. In other words, Biden's policies have cut oil supplies by as much or more than the OPEC+ cut.

– Alex Marlow & John Carney

Breitbart News Network