The Housing Rebound: More Evidence from Existing Home Sales

There were more green shoots of a recovery in the housing market to be seen on Tuesday.

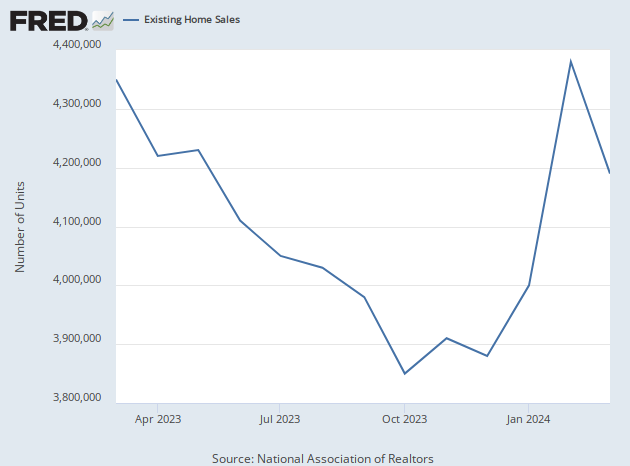

The National Association of Realtors said that sales of existing homes surged 14.5 percent in February, the largest monthly gain since the Flight from the Cities — the pandemic and riot-induced housing rush in June of 2020 when sales jumped a record-breaking 20.7 percent. This was the first monthly rise in sales following 12 consecutive months of declines, the longest streak of falling sales in records going back to 1999.

Sales were at a seasonally adjusted, annualized rate of 4.58 million, significantly above the forecast of around 4.2 million. Most importantly, there was a big jump in the single-family category. Single-family home sales rocketed to a seasonally adjusted annual rate of 4.14 million in February, up 15.3 percent from 3.59 million in January.

Sales Were at Very Depressed Levels

Although these are jumping off the very low and depressed figures from January, the stronger-than-expected rise supports the case we made here last week when we argued that the U.S. housing appears to have bottomed. Housing starts rose 9.8 percent in February, and permits jumped 13.8 percent. Homebuilder sentiment was up for the third consecutive month in March.

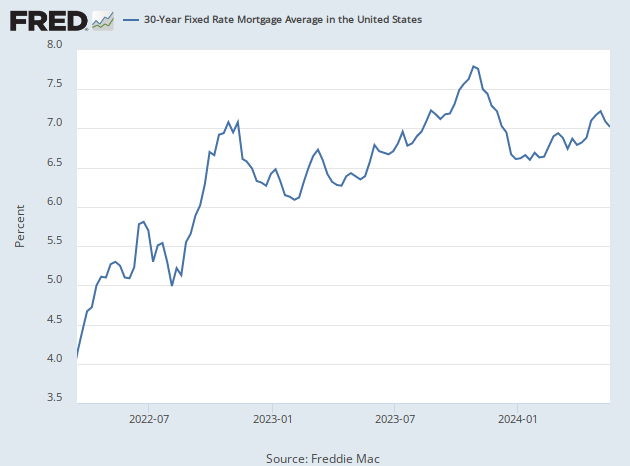

This is all the more remarkable because interest rates were rising through most of February. Although down from the October peak, rates climbed week-to-week in February, and the average rate on a 30-year fixed mortgage in February was 6.60 percent. So, this was not primarily driven by cheap money.

Lower prices and the strikingly strong jobs market played a role. The median price of a home sold in February was 0.2 percent lower than 12-months earlier. The median for a single-family home was down 0.7 percent.

(iStock/Getty Images)

Another driver is probably just an adjustment in buyer expectations. After years of very cheap mortgages, the sudden rise last year left many people with sticker shock. After several months of rates above six percent, American home buyers are adjusting to the higher rates.

Inventories of existing homes for sale remain far below pre-pandemic levels at a seasonally adjusted 1.13 million. That is up significantly from a year ago and identical with January. Many homeowners who financed their homes when rates were at three percent or lower are understandably reluctant to sell their current residence to trade into a much pricier mortgage.

Will the Banking Crisis Kill Off the Green Shoots?

There is a danger that the crisis currently roiling the American banking sector could bring a late frost that kills off the green shoots of the housing market. Lending standards for residential real estate were already tightening in the fourth quarter of last year, according to the Federal Reserve’s Senior Loan Office Survey. A liquidity crisis at banks may cause them to tighten even further.

On the other hand, mortgage rates fell last week as bond yields plunged. It would make sense for banks to be eager to bolster their balance sheet with new mortgages paying higher rates. Certainly, smaller lenders would love to see some additional churn in the local real estate market that would take out some of the ultra-low mortgages on their balance sheets.

There’s at least a credible argument to be made that while banks may cut back on non-real estate consumer lending, commercial real estate lending, and lending to businesses, they could try to keep the mortgage business flowing in an attempt to repair their balance sheets from the damage done by the rate hikes. That would allow the housing recovery to bloom this spring.

COMMENTS

Please let us know if you're having issues with commenting.