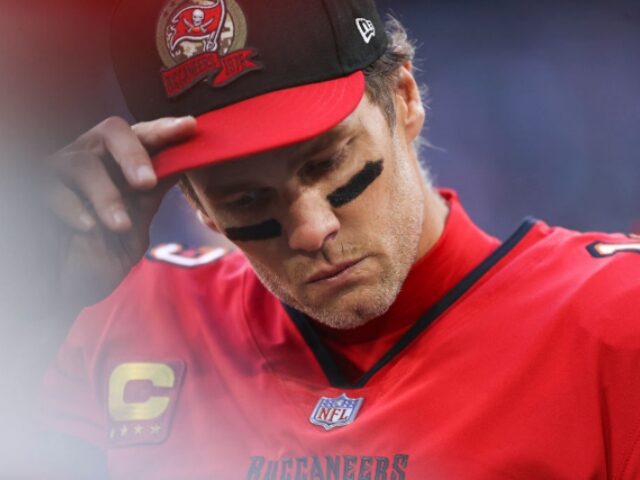

NFL star Tom Brady, his ex-wife model Gisele Bündchen, comedian Larry David, and other celebrities are being sued by cryptocurrency investors following the collapse of FTX.

In addition to FTX founder and CEO Sam Bankman-Fried, investors are suing celebrity endorsers, such as Tom Brady, Gisele Bündchen, Larry David, David Ortiz, Steph Curry, and Shaquille O’Neal, according to a report by the New York Post.

“Part of the scheme employed by the FTX

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange Photographer: Ting Shen/Bloomberg via Getty Images

Entities involved utilizing some of the biggest names in sports and entertainment — pouring billions of dollars into the Deceptive FTX Platform to keep the whole scheme afloat,” the lawsuit states.

Larry David, for example, had filmed a Super Bowl commercial for the now-bankrupt FTX. He and other celebrity endorsers are accused of participating in deceptive practices to sell FTX yield-bearing digital currency accounts, the suit adds.

Brady and Bündchen were also featured in FTX commercials, and purchased equity stakes in the company, which filed for bankruptcy on Friday after it was discovered that Bankman-Fried’s firm Alameda Research had allegedly traded billions of dollars from FTX customers’ accounts and leveraged the crypto exchange’s native token as collateral.

Other familiar names listed as defendants in the lawsuit include Shark Tank investor Kevin O’Leary, Jacksonville Jaguars quarterback Trevor Lawrence, tennis player Naomi Osaka, and Miami Heat star Udonis Haslem.

The lawsuit was filed by attorneys on behalf of Oklahoma resident Edwin Garrison — and others like him — who had an FTX yield-bearing account that was funded with crypto assets.

Bankman-Fried, who had an estimated net worth of $16 billion at the beginning of the week, is now completely broke, according to calculations by Bloomberg — an incident that the outlet referred to as “one of history’s greatest-ever destructions of wealth.”

FTX was “ultimately a Ponzi scheme, misleading customers and prospective customers with the false impression that any cryptocurrency assets held on the Deceptive FTX Platform were safe and were not being invested in unregistered securities,” the lawsuit states.

On Friday, Bankman-Fried announced his resignation as CEO and said that Alameda Research would be shutting down. The disgraced FTX founder and Democrat megadonor has also since put his 12,000-square feet penthouse in the Bahamas up for sale for nearly $40 million.

You can follow Alana Mastrangelo on Facebook and Twitter at @ARmastrangelo, and on Instagram.

COMMENTS

Please let us know if you're having issues with commenting.